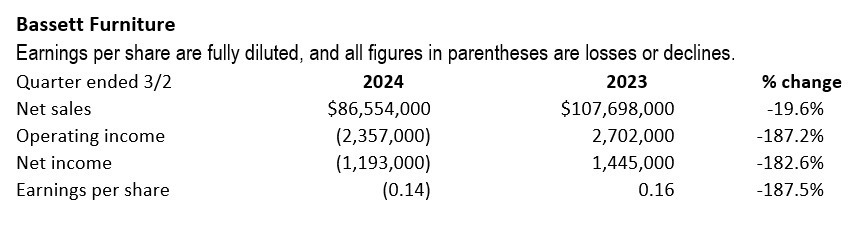

Bassett sees third consecutive loss in Q1, with sales falling 19%

BASSETT, Va. – Bassett Furnishings reported $86.6 million in consolidated very first quarter sales, a 19.6% decrease from past calendar year and an $8 million drop from final quarter. It also recorded a web decline of $1.2 million, marking its third consecutive quarterly reduction.

Wholesale profits fell 21.7% to $54.7 million for the quarter, while retail revenue fell 17.2% to $53.8 million. Both of those segments have now described similar declines for the past three quarters.

The firm attributed its overall performance to a demanding revenue setting and to an in particular weak close of January triggered by storms. On the upside, the organization generated its highest at any time gross margin, with gains driven by charge and shelling out reductions.

“We created an operating decline of $2.4 million and a web reduction of $1.2 million in the challenging product sales natural environment,” reported Robert H. Spilman, CEO. “Our consolidated gross margin of 55.3% was an all-time substantial, but shelling out reductions ended up not enough to create profitability at the reported amount of sales. We keep on to investigate price reduction approaches that will not be detrimental to gaining current market share in the competitive furniture business landscape.

“Wholesale and retail orders had been extra secure and fell by 6.3% and 3.4%, respectively (14 months vs. 13 weeks),” he continued. “The ultimate two weeks of January proved to be especially damaging to prepared gross sales throughout the interval as we missing the historically sturdy MLK holiday break occasion due to storms throughout a number of areas of the nation wherever we be expecting to publish great enterprise.”

Spilman pointed out that inventory levels are steady and “appropriate.” The firm continues to trim its headcount.

“Total headcount in our wholesale section has been lowered by 26% considering that the peak of the pandemic booms in 2022,” he reported. “The corporate retail corporation is 44% leaner than February 2020, the last month in advance of the world modified. And the balance sheet is effectively-constructed and delivers stability as we concentrate on improving upon outcomes in anticipation of a superior macro-economic ecosystem in the long run.”

On the retail aspect, the enterprise opened two new stores in the course of the quarter. No further more stores are prepared for 2024.

“We were being enthusiastic to open new retailers in Tampa and Houston,” Spilman claimed. “Startup expenditures recorded on the profits statement have been in surplus of $700,000. Our ordinary ticket was $3,800, and 41% of revenue arrived from layout jobs as we generally produce a more compact proportion of layout business all over the holidays. We did not curtail retail advertising and marketing bills for the quarter, even though we are presently slicing back again prior to selecting up yet again in May perhaps for the Memorial Working day marketing.”

In e-commerce, the company plans to consolidate its distribution by removing 5 warehouses.

“On the electronic entrance, we are continuing to optimize our methods to develop our omnichannel capabilities and boost website conversion,” Spilman explained. “Declining created and delivered income of course utilize force to results by way of the deleveraging of SG&A fees.

“On the expenditure aspect, we are at the early stages of employing a new retail distribution model created to decrease warehouse and shipping and delivery expenses by 200 foundation factors. The first phase of this prepare will do away with five services that are presently in use generally in the mid-Atlantic location. Following evaluation of the results, we approach to put into action further more warehouse consolidations in other locations,” he explained.

“On the profits entrance, we program to sharpen the value proposition of a part of our assortment with the addition of various new items that we consider will enhance the extensive array of customizable furniture that presently dominates our suppliers.”

In wholesale, Spilman cited a problem in balancing domestic ability with purchase backlogs. The enterprise also is now sourcing products from India.

“Our workforce manufactured a 200-basis level gross margin advancement for the quarter,” he mentioned. “Embedded in the wholesale outcomes is the return to profitability of the Club Degree movement assortment which has been a drag on the base line in new quarters. We be expecting further more improvement in the Club Stage final results in the forthcoming months.”

Spilman stated production has started on its modern day-styled reliable maple Parkway bedroom and the “more commonly priced” Origins eating. The very first parts of the company’s new premier tailor made leather upholstery line have been manufactured, which Spilman reported offered nicely in the remaining months of the quarter. India-produced case goods have authorized for additional artistic design, but have been negatively affected by lengthier guide times prompted by Red Sea turmoil.

“As we consider to point out every single quarter, we proceed to keep a robust equilibrium sheet to temperature downturns like the 1 we are in now though supporting the dividend,” Spilman concluded.

See also:

- Bassett records next consecutive quarterly loss as sales fall 21%

- Bassett’s preliminary Q3 numbers exhibit dip in revenue, income

The write-up Bassett sees third consecutive reduction in Q1, with revenue falling 19% appeared initial on Furnishings Now.