Kerplunk – Macy’s home sales drop below 2019 benchmark

NEW YORK – For the earlier two a long time, residence phase profits at Macy’s Inc. have contracted at a a lot quicker level than the company’s general product sales declines.

In addition, 2023 property sales fell underneath $4 billion for just the second time in 5 years, coming in at $3.79 billion. The past time that occurred was during 2020, when the COVID-19 outbreak compelled Macy’s to close its complete shop fleet for a number of months.

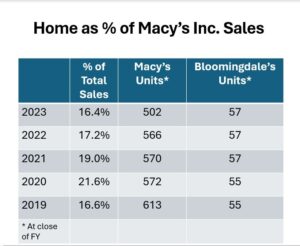

Though Macy’s Inc. operated 109 less shops past yr than it did in 2019, the ratio of dwelling segment product sales to whole enterprise revenue was about the identical in 2023 and 2019: 16.4% and 16.6%, respectively.

Still, the fall-off in residence phase gross sales is receiving steeper. In both equally 2023 and 2022, Macy’s Inc. property segment product sales fell virtually 10%, marking a sharper fall-off than whole organization sales, which declined 5.5% and .7%, respectively.

Except if digital functions for Macy’s and Bloomingdale’s take care of to significantly choose up the slack, the company’s share of the property segment is probable to keep on shrinking. In late February, the business introduced options to shutter 150 underproductive Macy’s places by the close of 2026.

The corporation options to roll out a lot more Macy’s modest-structure principles in addition to the 350 go-ahead Macy’s units. Having said that, the total of place devoted to dwelling in those people formats will not switch the footage that will evaporate as the full-line stores slated for closure go darkish.

See also:

- Posting sluggish Q4 effects, Macy’s says 2024 will be a transitional year

- Macy’s wiping out a lot more merchants as it pursues “bold new chapter”

The write-up Kerplunk – Macy’s household income fall underneath 2019 benchmark appeared initial on Home furniture Today.